Early in my journey as a trucking business owner, I crossed paths with another owner-operator who harbored dreams of transitioning into a carrier. However, he was hesitant because he thought it was too complicated. I told him that even though I had only just started I thoroughly enjoyed it and thought he should do it. My enthusiasm seemed to strike a chord. He seemed somewhat convinced and said to me “Okay, maybe I can do it, so what’s your process?” This question caught me off guard. Even though I definitely had a process, I could not describe it to him. I had not refined it enough for easy explanation and I had not documented the steps so I could easily provide them. When I couldn’t tell him my process I could see that I lost the moment of persuasion. His perception of my struggle reinforced his belief that the transition was too intricate for him to undertake.

I feel like it is my mission as a truck driver with the knowledge and skills to do this job successfully to be able to share this knowledge and help other drivers to learn to transition to being independent. I feel this way because I know how rewarding it is because so much happiness can result from the freedom derived from being your own boss as a truck driver. So, I vowed to put my process in a form where I can share it with others. That is why I am creating the White Glove Trucking Core Curriculum and Tools for Business, a series of blog posts that outline my process and provide practical tools to enhance operational efficiency and cost-effectiveness.

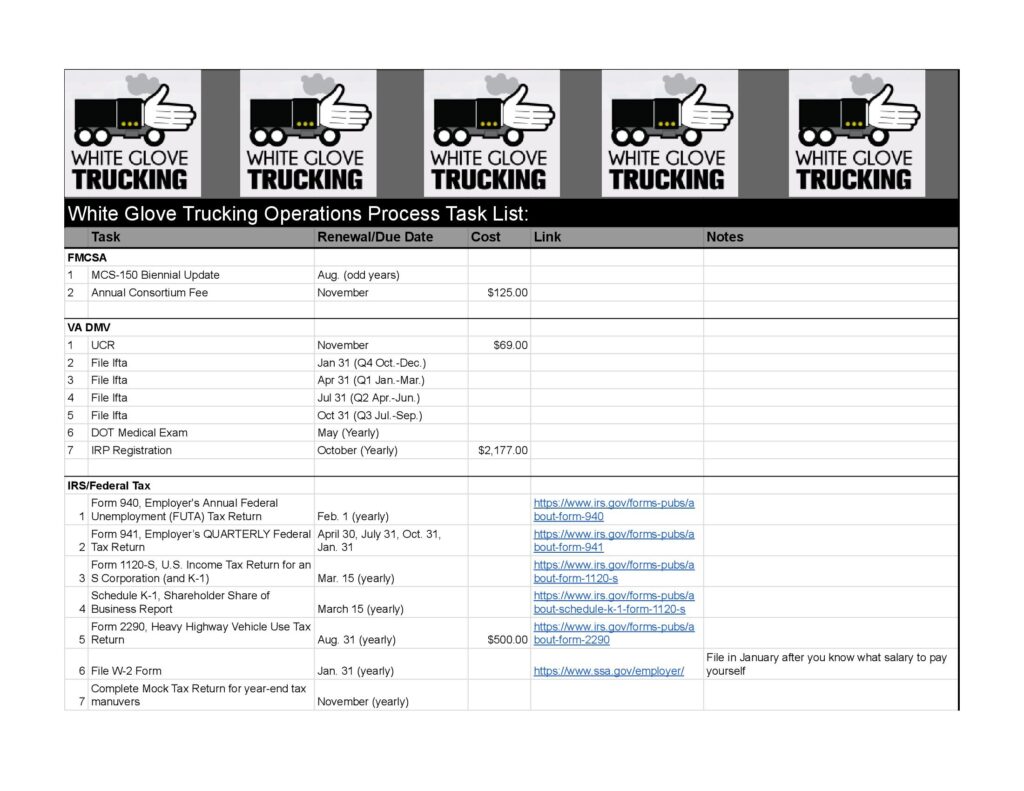

This blog post presents my operations process task list, a checklist that ensures I consistently fulfill all daily, monthly, and quarterly carrier responsibilities. The sheer volume of tasks involved in being a carrier can be overwhelming, making it easy to overlook crucial aspects. For example, during my first year of operations, some states required monthly reporting and some were quarterly. I mistakenly thought they were all quarterly and was penalized with late fees. This checklist serves as a memory aid helping to avoid this type of mistake.

“I mistakenly thought they were all quarterly and was penalized with late fees.”

Here is a brief description of select items in the checklist:

The Motor Carrier Identification Report (MCS-150) is a form used by the Federal Motor Carrier Safety Administration (FMCSA) to collect information from companies involved in interstate transportation of property or passengers. The Biennial Update is a requirement for updating this information every two years.

Unified Carrier Registration (UCR) is a federally mandated system for registering companies involved in interstate transportation of goods. It requires payment of fees based on the size of the fleet and is intended to fund state motor carrier safety activities.

DOT Clearinghouse/Random Testing Consortium: A consortium that facilitates compliance with the Department of Transportation (DOT) regulations regarding drug and alcohol testing for employees in safety-sensitive positions within the transportation industry. Members of the consortium share resources for conducting random tests.

IFTA (International Fuel Tax Agreement): IFTA is a North American agreement between U.S. states and Canadian provinces to simplify the reporting of fuel use by motor carriers that operate in multiple jurisdictions. It eliminates the need to pay multiple taxes to each individual state you travel through.

DOT Medical Exam: A physical examination required by the Department of Transportation to ensure that commercial vehicle drivers meet specific health and fitness standards necessary for safe operation. Required every two years.

IRP Registration (International Registration Plan): A registration agreement for commercial vehicles that operate in more than one jurisdiction. It allows for the proportional registration of vehicles based on the miles traveled in each jurisdiction. Required every year.

IRS Form 940: Employer’s Annual Federal Unemployment (FUTA) Tax Return. It is used to report and calculate the amount of federal unemployment tax owed by employers.

IRS Form 941: Employer’s Quarterly Federal Tax Return. Employers use this form to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks.

IRS Form 1120s: U.S. Income Tax Return for an S-Corporation. This form is used by S-corporations to report their income, deductions, and credits to the IRS.

IRS Schedule K-1: A tax document used to report the income, deductions, and credits distributed by a partnership, S-corporation, estate, or trust to its partners, shareholders, or beneficiaries.

IRS 2290, Heavy Highway Vehicle Use Tax Return: It is used to report and pay the federal excise tax on heavy vehicles operating on public highways. Required every year.

NY HUT (New York Highway Use Tax): A tax imposed on motor carriers operating certain motor vehicles on New York State public highways. It is required for vehicles with a gross weight of 18,000 pounds or more.

Kentucky KYU: Kentucky Highway Use License: It is required for vehicles with a gross weight of 60,000 pounds or more operating on Kentucky highways.

VA Form 502: Virginia Resident Income Tax Return. It is used by residents of Virginia to file their state income tax returns.

VA Form 760: VA Form 502 is used for completing a pass-through entity return for business owners. It applies to individuals involved in business entities such as partnerships, S-corporations, or limited liability companies (LLCs) that are treated as pass-through entities for tax purposes.

W-2 Form, Wage and Tax Statement: Employers use this form to report wages, tips, and other compensation paid to employees, as well as the taxes withheld. Employees use it when filing their income tax returns.