I recently did a blog post, Budgeting for New Equipment and Retirement , on saving for new equipment purchases, particularly focusing on the pivotal decision of acquiring a new truck and trailer. In this blog post, I wanted to do a short blog post to emphasize in a visual way the money you can save by planning ahead for your truck purchase, rather than opting for financing.

Let’s visualize this journey together: picture yourself making dedicated truck payments, but here’s the twist – one way, you’re channeling those funds into your own pocket four years in advance, while the other involves payments to the bank when the need for the truck arises. It’s a truck payment either way, but the key lies in where that hard-earned money ends up.

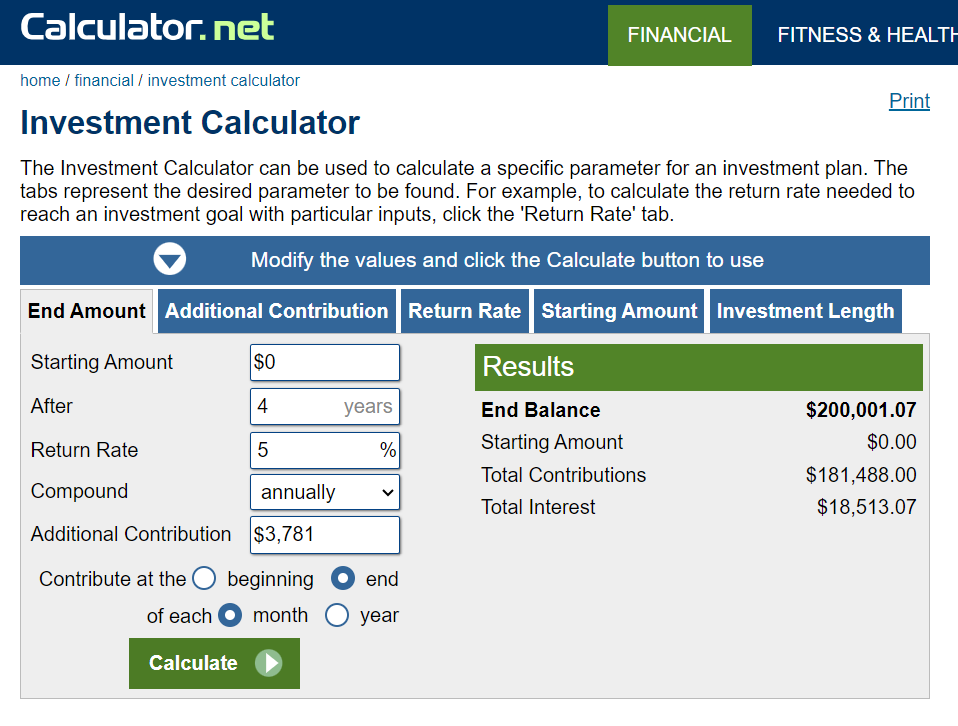

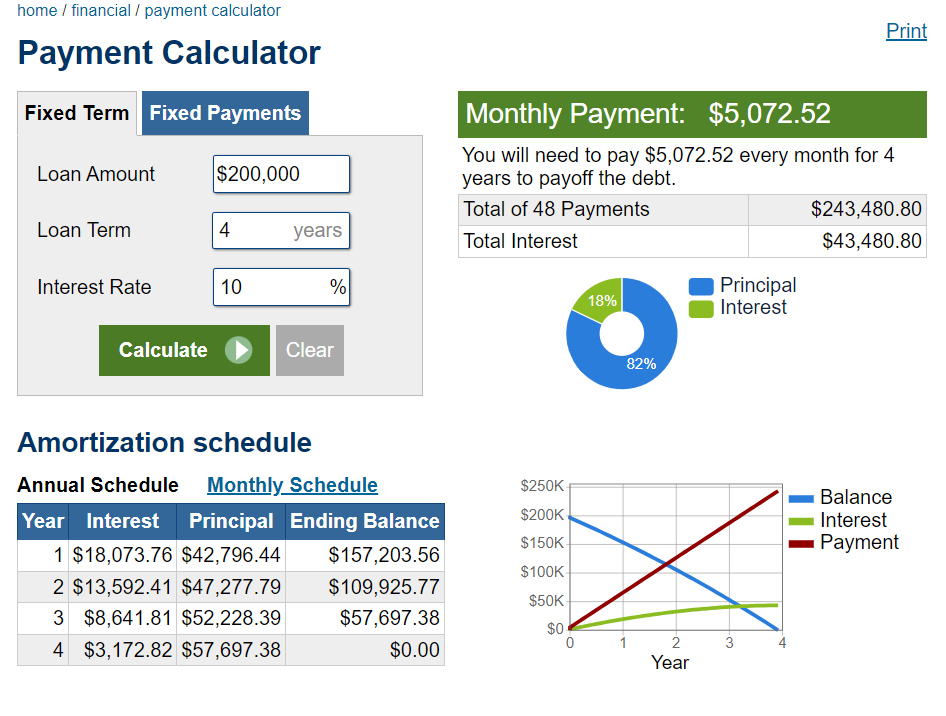

If you commit to saving for a new truck purchase over four years with a 5% interest rate, you’d need to squirrel away $181,488, translating to a manageable $3,781 per month. On the other hand, if you opt for financing at 10%, your monthly payment skyrockets to $5,072, resulting in a grand total of $243,481 over the same four-year period. That’s a jaw-dropping difference of approximately $62,000, with a monthly saving of $1,300.

It’s almost infuriating how the amount of interest one earns over the entire four years of saving is almost equal to the interest paid to the bank in just the first year of the loan. Therefore, isn’t it incredible how a little foresight and a dash of financial planning can make such a substantial impact? By choosing the route of early savings, you’re not just acquiring a truck – you’re securing your financial well-being and keeping more of your hard-earned cash where it belongs – in your pocket.

Happy trucking, and may your roads be paved with savings!