Introduction:

In the realm of transportation, the International Fuel Tax Agreement (IFTA) plays a crucial role in streamlining the reporting and payment of fuel taxes across multiple states. Carriers complete their IFTA filing each quarter to remain in good standing. For a fee ELD services will file IFTA for carriers. The White Glove Trucking IFTA filing spreadsheet helps carriers file IFTA for free.

What is IFTA?

IFTA is a cooperative arrangement among the lower 48 states of the United States and the Canadian provinces (excluding Northwest Territories, Nunavut, and Yukon). IFTA enables motor carriers to report and pay fuel taxes based on the total distance traveled in all participating states. This eliminates the need for carriers to obtain multiple fuel tax permits, reducing administrative burdens and ensuring tax equity.

When do you need to file IFTA?

Motor carriers are required to file IFTA if their qualified vehicles operate across two or more member states and meet certain criteria. A qualified vehicle is defined as a motor vehicle or combination of vehicles that has three or more axles, or two axles and a gross vehicle weight rating (GVWR) exceeding 26,000 pounds, and is used for transporting persons or property. If your fleet operates within a single state or does not meet the weight threshold, IFTA filing may not be necessary.

How do you file IFTA?

Filing IFTA involves several key steps to ensure accurate reporting and payment of fuel taxes:

a) Obtain an IFTA license: Carriers must first apply for an IFTA license through the state in which they are based. The license is renewable annually and permits the carrier to report and pay fuel taxes to all participating states.

b) Maintain detailed records: Out of all the things that I do to manage my business, IFTA is the one thing I do every day. You have to maintain precise records of all miles driven and fuel purchased within each state. You can’t really skip a day because if you’re driving over-the-road you’re most likely crossing a state line. Or, if you’re getting fuel you need to track it for IFTA.

c) Calculate fuel tax liability: At the end of each reporting period (typically quarterly), carriers need to calculate their fuel tax liability for each state. This is determined by multiplying the total miles traveled in a state by the fuel tax rate set by that state.

d) File your IFTA reports: Carriers must file their IFTA reports with their base state. These reports provide a breakdown of the distance traveled and fuel consumed in each participating state. Payment of the calculated fuel tax liability is also made with the filing.

What happens if you don’t file?

Non-compliance with IFTA filing requirements can have serious consequences for carriers, including:

a) Penalties and fines: Failure to file IFTA reports or pay the required fuel taxes can result in significant penalties and fines imposed by both the base state and the states in which the carrier operates. These penalties vary among states but typically involve monetary fines based on a percentage of the unpaid tax liability.

b) Audit and enforcement actions: Carriers who do not file IFTA or consistently fail to comply may be subjected to audits and enforcement actions by the relevant tax authorities. Audits may involve a thorough examination of the carrier’s records and operations to assess their compliance with IFTA regulations. Enforcement actions can include additional penalties, license suspensions, or even legal action.

c) Restricted operations: Non-compliant carriers may face restrictions on their ability to operate within the participating states. This can lead to disruptions in business operations, loss of revenue, and damage to the carrier’s reputation within the industry.

There are easier ways to file but it will cost you:

There are different ways to file your IFTA. Many electronic logging devices (ELD’s) will do it for you. The ELD’s will gather the information you need to file such as miles, fuel, etc., but typically you will have to pay for an ongoing subscription for this service and they average about $500/yr. according to FMCSA. They will track you as you enter a new state and record your mileage. If you want to do it the absolute easiest way then these are your best bet. However, if you are reading my blog then you know I am all about saving money and helping you to do the same.

Use the White Glove Trucking IFTA spreadsheet to File your IFTA reports:

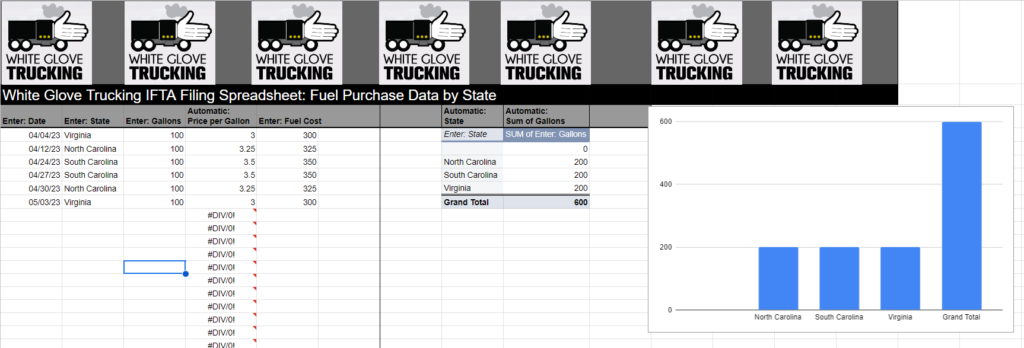

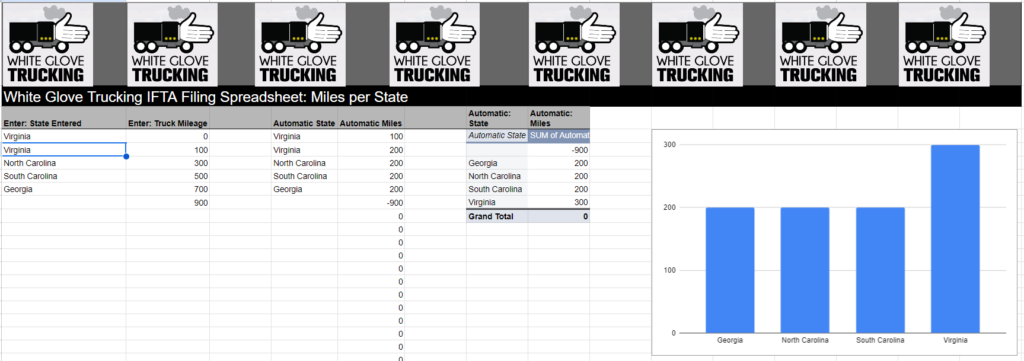

I have created a sheet I use to track my miles traveled and fuel purchased in each state. Each time I cross a state line I open the sheet and input the state and mileage. The sheet automatically calculates the total miles traveled in each state. Each time I fuel up I input the date, state, gallons, and cost. The sheet automatically calculates the total gallons in each state. So at the end of the quarter all I have to do is input this information into my state’s online IFTA reporting system. It typically takes me only about 20 to 30 minutes to file online using Virginia’s online system. Doing my IFTA this way saves me from having to pay for an ongoing ELD subscription. I bought a GARMIN ELD when I first started for $99.00 and that was the only ELD related cost I have ever had to pay.

Conclusion:

In conclusion, the International Fuel Tax Agreement (IFTA) provides motor carriers with a standardized framework for reporting and paying fuel taxes across multiple states. While there are convenient electronic options available for filing IFTA, they often come with ongoing subscription costs. For those looking to save money, utilizing the White Glove Trucking IFTA filing spreadsheet can be an effective alternative.

Note: I am still learning how to make the spreadsheets available on the website. So at this time, please email me at [email protected] if you would like a copy of the White Glove Trucking IFTA filing spreadsheet. Thanks!