Introduction:

Acquiring insurance is required by the Federal Motor Carrier Safety Administration (FMCSA) before you can obtain your operating authority. When starting a trucking company, insurance becomes one of the most significant fixed expenses alongside truck and trailer payments. As a truck driver and owner operator, I understood the importance of finding the best insurance options to maximize savings and ensure the success of my business. In this blog post, I will share my experience of exploring alternatives to Progressive insurance, demonstrating how meticulous research can lead to substantial cost reductions. By not settling on Progressive, I saved close to $10,000 annually on insurance costs. Read on to discover the steps I took and the lessons I learned.

After your truck, insurance will likely be your highest expense:

When you start your trucking company one of the highest expenses you will have right alongside your truck and trailer payment is your insurance payment. Trucking insurance cost is so high that it is often the primary obstacle that prevents drivers from acquiring their own trucking authority. Many insurance companies won’t insure new trucking ventures. Because most new owners are aware that Progressive will, it is often the go-to choice for many new businesses, despite its hefty price tag. Furthermore, insurance agents commonly recommend starting with Progressive for the first year, promising cheaper alternatives for the following year.

For the cheapest insurance make sure your Commercial Drivers License (CDL) State and business state are the same

After many calls to different insurance agents, I found an insurance broker that I liked. He submitted my driving history to various insurance companies but they would not insure me or their rates were too high. My broker told me that one detail in particular was significantly raising my rates—I held a CDL from a different state than the one where my company was registered. Residing in California when I began my trucking journey, I obtained a California CDL. However, I had since returned to my home state of Virginia and registered my Limited Liability Company (LLC) there. To secure the best insurance rates, I needed to align my CDL state with my business state by switching my CDL to Virginia.

I lost my Hazardous Materials (HazMat) endorsement when I switched my CDL from California to Virginia:

While transferring my CDL from California to Virginia, my tanker, doubles, and triples endorsements successfully transferred. However, to transfer my HazMat endorsement, I would have had to retake the test. Considering the significant insurance cost increase associated with HazMat loads, I decided it was not worth pursuing and ultimately lost my HazMat endorsement.

Progressive seemed like my only option

Now that my CDL and company were both in the same state, I was ready to get the best insurance rate. Yet, my insurance broker said that he applied to multiple insurance companies but the only one available to me was Progressive. He assured me of his expertise in negotiating with Progressive and promised the best rate. He got me a rate of about $19,000 annually. After he secured my progressive rate he was ready to bind it but I delayed. I opted to delay binding the insurance until my FMCSA authority registration approval drew closer.

Time your insurance so that you pay the least amount necessary before you’re actually driving the truck:

I didn’t want to be paying for insurance until I could actually drive and be making money. You want to bind it early enough to not delay your application with FMCSA while paying for it as little time as necessary before you can drive and make money. In the trucking business, every mile, gallon, and dollar matters. This type of financial decision, which individually seems insignificant, when added together accumulates to substantial amounts of money in your pocket at the end of the year. These decisions determine whether you have a great year or a mediocre one. Delaying the binding of insurance until it is necessary, ensuring it aligns with the moment you start driving, is one such decision. In my case, this approach allowed me to pay for insurance for only one week before I could legally use my truck.

Keep Researching and Don’t Settle

And that actually brings me to how I saved close to $10,000 on insurance. I approached insurance shopping the same way I approach most things, which is not to just go by what everybody else is saying and doing but to actually do the research and see for myself. While I delayed binding with Progressive, I continued to search for better options. That’s when I received a voicemail from a lesser-known company called Great West. I returned their call and I discovered that they insured new companies and offered really competitive rates so I decided to go with them as my insurer. This turned out to be a great decision and I have been using Great West and reaping significant financial benefits ever since.

Jump start your research with these resources:

To assist you in your search for more affordable insurance, I have three resources that may help:

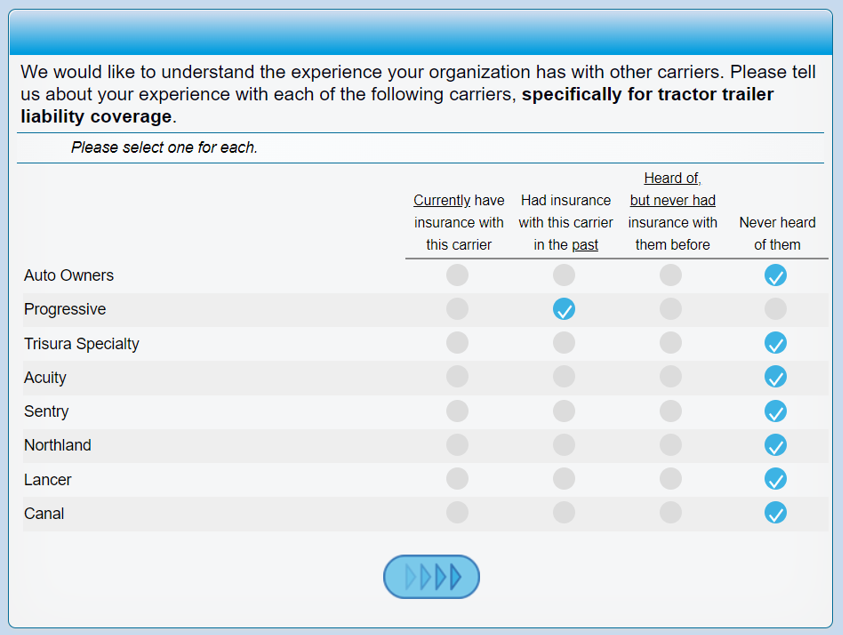

The first resource is a collection of companies Great West considers it’s competition. This list was in a great West survey they sent me. I thought it might be a good idea to grab a screenshot of it just in case I needed to shop around later.

The second resource is a collection of some marketing emails I received from insurance agents. I typically receive a bunch of these emails just before my insurance is up for renewal. Disclaimer: Except for David Carr (my personal Great West agent) and Jason Huff (the initial Progressive broker I dealt with) I have not vetted any of these, but at least they may be a place to start your research.

The third resource is a few questions to ask the insurance agents and brokers to help you during the process (these may also help identify if they might be shady). I got these questions from a Land Line Magazine podcast.1

Ask whether your agent is doing their underwriting up front or afterwards?

This is important because if they’re doing it afterwards your rate could increase once the underwriting is completed.

If you have to provide an initial deposit up front, ask if the deposit is refundable?

This is important should you cancel early.

Ask if it Is a prorated policy or a short-rated policy?

Prorated means you only have to pay for the period you used if you cancel. This is what you want.

Short-rated is when there are some costs you won’t get back if you cancel. This means you pay for more than you actually used. This is what you don’t want.

1. https://landline.media/podcast/podcast-getting-your-ifta-right/