Introduction – My Insurance Dropped Me

My insurance dropped me. Technically, they decided not to renew my policy. The law requires that they give carriers 30-days notice which isn’t much time so I better get going. Navigating the complexities of truck insurance can be as challenging as the daily rigors of the road itself. In this blog post, I share my recent experiences with insurance, from being dropped by my provider to exploring alternatives and learning valuable lessons along the way. Join me as I discuss the practical insights gained from handling claims, dealing with safety violations, and making strategic decisions to safeguard my business against this existential risk.

Claim Based Probation

First, I received a letter stating that Great West was placing me on probation. The letter stated:

“Any further issues encountered by the driver during the underwriting probation period could change the status of the driver to one who is “rejected” for underwriting reasons and possibly affect your insurance policy with Great West.”

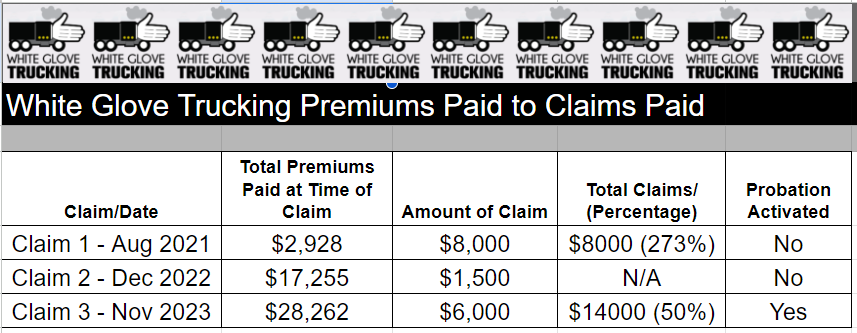

Confused, I emailed my insurance agent to ask why I was being placed on probation and what I needed to do to get off of it. An administrative assistant told me that, upon checking the system, it appeared my probation was due to my claim history. Over the three years with Great West, I had three claims:

- Hit and run at a truckstop ($8000): While parked at a truckstop, someone backed into my truck damaging the side skirt and bracing. I tried to locate the culprit but the cameras weren’t working at the TA so I had to make a claim on my insurance.

- Collision with a Drunk Driver on I-80 (Two new drive tires = $1500): This happened in Utah on Christmas Eve. While coming up from behind, a driver lost control, veered off the road, and overcorrected so that he drove head-on into my rear wheel. I pulled over and rode my bike back to the scene of the accident only to find a bunch of debris in the road but no vehicle. The guy had fled the scene. Later, while on the phone with the police, the officer asked if there was any identifying information. I checked the road but there was nothing. However, as I was walking alongside the truck, I noticed something lodged in my wheel. I yanked it out to find it was the front piece of the bumper with the license plate intact. When the officer arrived on the scene, he informed me that other officers had gone to the guy’s home and found the car all mangled and him reeking of alcohol.

At one point during the incident, the officer asked if I happened to know how fast I was going. I told him that I knew precisely how fast because I always set the cruise to the same speed–58 mph. He gave a slight pause, seemingly doing a quick calculation, before asking why I chose to drive so slowly when the permitted speed is 80 mph. I told him I drive that speed primarily for safety and fuel savings but that it’s also just a more enjoyable way to drive. He nodded as if finding the answer acceptable, and we moved on to discuss the Christmas dinner he had only just sat down to enjoy when he got the call.

Afterward, I reflected a lot on the accident and the officer’s hesitation. I have never mentioned this to anyone but I have wondered if my slow driving speed played any role in that accident. While the other driver’s insurance paid the claim and I know that I would not be found at fault officially, I speculated on this from a personal safety perspective. The conclusion I reached is that while driving slowly is generally safer, it is not a foolproof solution. There may be trade-offs, as driving slowly makes you safer in many ways–you have more reaction time, there is less damage if in an accident, and there’s less chance in accident will result in a fatality–but potentially less safe in others because we don’t drive in a bubble, but within a complex, integrated system.

One of the things that has helped me a lot in life is always asking myself what part of an issue might be my fault. What is my part in the problem? Even in situations where it seems unnecessary, asking this question helps me see where I need to course correct. This introspection allows me to take more control over a greater number of the things that happen to me in life. It’s like expanding your reach or locus of control and over time greatly helps to improve your life outcomes.

- Hitting a Deer ($6000): The deer took out my bottom right bumper and its antlers took out my right headlamp assembly. Of the three claims, this is the only one for which I was at fault and it was soon after this one that I received the probation letter.

The lesson I learned from this is that It’s crucial to understand an insurance company’s policies regarding probation and rejection due to claims before signing up. Questions to ask include: How many claims per year will put me on probation? How many claims will lead to rejection? Understanding these policies can help manage risks and maintain good standing with insurance providers.

Commercial Vehicle Safety Alliance (CVSA) Violations

After the administrative assistant informed me that my probation was due to my claims history, my actual agent contacted me with another reason: my CVSA violations. He said that even though he would love to keep me as a client, the underwriters had decided not to renew my insurance. At first, I thought he was just covering up the fact that they were really dropping me because of the claims. However, after speaking with various agents in the trucking insurance business, I learned that Great West is indeed very strict about safety violations. It’s possible that the non-renewal was genuinely due to these violations. One agent also speculated that it might have been related to me acquiring all brand-new equipment with a higher value than what I had before.

Perhaps my Great West agent knew I would be skeptical so he sent me an email listing my 9 CVSA violations. Here is what they were:

- Driving on a suspended CDL

- False report of driver’s record of duty status

- False log book

- Headlamp issue

- Tire issue

- Wheel, Studs, clamps issue

Additionally, I had rented a Convoy trailer for one month while my trailer was being repaired. Naturally, I got inspected during that time, and the rented trailer had its own issues, resulting in three more violations.

Admittedly, when viewed collectively, these violations seem alarming and suggest that I might be unsafe. However, if I were to explain each one, you would realize that these issues are minor and not indicative of my overall safety as a driver.

While I won’t go through all of these violations, I will highlight two of them to provide lessons that might help you avoid the same problems I faced.

Driving on a suspended CDL

The violation for driving on a suspended CDL in Idaho was a result of my license being suspended in New York due to an unpaid seatbelt ticket I received while visiting NYC ten years ago. I had completely forgotten about this ticket, which I received before I even had a CDL. Idaho flagged this because they participate in a nationwide system that links driver’s license statuses across states.

The lesson here is when you decide to start your own trucking company or decide to get a CDL in general, make sure you take care of any outstanding tickets and licensing issues because they can follow you to your CDL which, once you have it, makes the consequences of not addressing these things greater. Now instead of just having to pay a couple hundred dollars to New York, I got an Out of Service (OOS) violation and the cost associated with that and higher commercial truck insurance and the cost associated with that.

False Log Book – Issue of Personal Conveyance (PC)

I received a violation for a false log book due to my extensive use of personal conveyance (PC). It took me some time to transition from how I was used to using PC as a company driver to how I needed to use it as a Carrier/Owner Operator. As a company driver, I didn’t use the truck for personal trips like I do as an owner-operator. As an owner-operator who stays out most of the time, I end up doing a lot of personal things for fun and adventure. The Hours of Service (HOS) regulations are not designed for this adventurous, lifestyle-driven type of trucking, especially when the carrier or company owner is also the driver.

For typical drivers, HOS rules work fine, but as an owner-operator living out of my truck, I frequently manage business tasks like getting maintenance done and this adds another layer of complexity. The PC system isn’t set up for these scenarios, leading to conflicts with HOS regulations.

If I were a driver employed by a company, my time spent on duties such as maintenance would need to be logged as on-duty to protect drivers from being overworked by predatory companies. However, as a business owner, going the extra mile is part of the job. This doesn’t mean driving beyond the 11-hour limit but being willing to work longer hours overall to ensure business success. Anyone starting a business probably anticipates long, 16-hour days and doing whatever it takes to keep the business afloat.

Every time I went into an inspection station, the inspectors would see all the PC entries and I would receive warnings or violations. Over time, this accumulation of PC violations made it appear as though I was a dangerous driver. Inspection stations naturally look for low-hanging fruit, and personal conveyance logs are an easy target. As soon as inspectors see extensive PC use, they focus on it.

Weigh Station Inspectors and How Government Inspections Work

This is why there is no need hoping for leniency from the inspectors or get upset when you don’t get it. I worked for the government, so I know how this works. I also know that if they can give you the violation they will. When I worked in the government, we were incentivized to find problems and measured on how many we found and how many recommendations we made to improve the situation. Similarly, inspectors are incentivized to find problems, issue violations, and see to it they are repaired. When they spend time on an investigation, they are expected to produce results. Otherwise, their time is viewed as unproductive. As a driver who gets caught up in this, just be aware that it’s not even about you; it’s about the officer’s metrics and what they’re being measured on. They don’t care if in actuality you were using PC in a logical and safe way or that you have a perfectly reasonable explanation. It’s not personal in either direction. They are not out to get you but they are not out to give you a break either. They need to justify their work time and show effort in order to be successful at their job, viewed as a good performer, and get promoted. Additionally, inspection officers on the ground level at weigh stations probably lack the authority to use discretion or make case-by-case judgments and must adhere strictly to the rules.

My Solution Was Just to Stop Using PC Altogether

My solution was to stop using personal conveyance (PC) altogether. Now, whenever I drive for personal reasons, I disconnect my logging device. This means breaking a different rule—driving without my logs activated—but it avoids triggering violations due to PC usage by giving inspectors the low-hanging fruit they are looking for. While not ideal, I hope this method helps prevent inspectors from flagging my logs for PC violations.

I think as a safe driver and one who hates driving when tired, I am upholding the spirit of the law. Also, the law is meant to protect drivers from companies that try to overwork them. Since I am the company, I don’t have to worry about overworking myself or forcing myself to drive.

I must admit that this is not a perfect solution, and I am still experimenting to find the best approach. I can’t recommend that you follow this method, but I hope sharing my experience gives you something to think about and anticipate, helping you avoid PC violations and getting dropped by your insurance company.

How I Selected My New Truck Insurance Company

Now, I had to find new insurance, which is quite a hassle, especially when you’re driving and on the road full time. Insurance is one of the highest fixed costs for a carrier/owner-operator, so I wanted to do my due diligence to ensure I got the best deal.

The Federal Motor Carrier Safety Administration (FMCSA) requires carriers to have a minimum of $750,000 in liability coverage and $100,000 in cargo coverage. However, most of the brokers I work with require $1 million in liability coverage, so I needed to get quotes for that amount.

Attempted to Clean Up My Safety Record Using DataQ

My insurance agent told me that if any of my safety violations were wrong, I could dispute them using FMCSA’s DataQ system. I didn’t know about this system so I looked it up. DataQ is FMCSA’s system that allows truck drivers and carriers to challenge and correct data stored in its databases. This includes data related to safety violations and inspections. The program is designed to ensure the accuracy of records that can impact your safety rating and compliance standing. Through DataQs, drivers can submit requests to review and correct erroneous data, providing a mechanism to maintain accurate records and improve regulatory compliance.

Before seeking new insurance, I decided to try to dispute the violation I got for driving on a suspended CDL. I hoped that if I could get that removed, then my next insurance might be cheaper. I accessed the system through FMCSA’s website, located the violation and input my reason why I thought the violation should be dismissed. I explained that the violation stated my CDL was suspended in my home state, but that was inaccurate because New York wasn’t my home state. I also mentioned that I had called New York, paid to release the suspension immediately, and sent them the receipt as evidence.

I submitted the request and, after about a month, I received an email informing me that my request was denied. The email stated:

“You have not submitted any documentation or provided any evidence to support that this violation was written in error or was improperly documented on the inspection report. The Idaho State Police does not remove violations from inspection reports, unless the violation was improperly documented or written in error. The violations were properly documented and will remain on the inspection report.”

Researched Insurance Companies: Most Only Quote to Licensed Agents

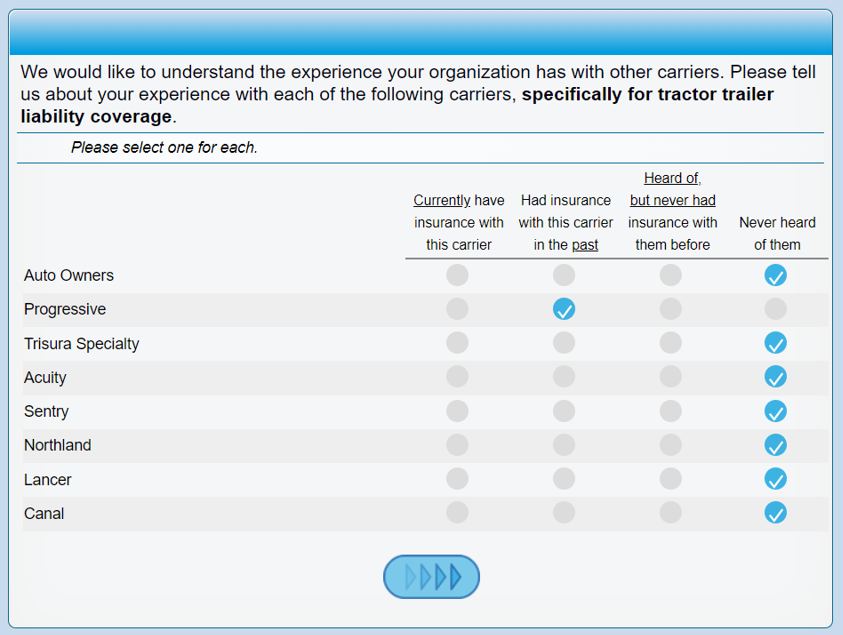

After my attempt to correct my safety record through DataQ didn’t work, I decided to start shopping for new insurance. In a previous blog post, I provided various insurance resources for those shopping for coverage, so I decided to begin there. I started with a list of Great West competitors I had from a survey screenshot. Here’s a list of them and the relevant information I gathered during my research. However, none of these companies would quote directly to me; they either didn’t respond or required me to go through an agent to get a quote.

- Acuity Insurance – They only cover a 600-mile radius from their building, located between Milwaukee and Chicago.

- Auto-Owners Insurance – Located in Lansing, Michigan. They seem like a smaller insurance company. I left a message for a callback but didn’t receive one.

- Sentry Insurance – They only quote through agents. Their website provided a list of local agents. One listed was Service Insurance Agents in Richmond (800-444-0205).

- Northland Insurance – The automated system directed me to their website for a quote (https://www.northlandins.com/trucking/owner-operator-truck-insurance). It provided a list of agents in my state. One agent was the same one recommended by OOIDA so I noted to make sure to check them out.

- Lancer Insurance – TNot available in Virginia. Only allows one truck in New York (844-527-9489 x4552; website: https://www.lancerinsurance.com/long-haul-trucking).

While at home and sorting through the mail, I noticed a few insurance advertisements. Normally, I would toss these in the trash, but since I was in the process of searching for insurance, I decided to call them.

- Amica – Doesn’t offer commercial truck insurance.

- Allstate – Doesn’t offer commercial truck insurance.

- Farmers Insurance – Uses a subsidiary that ultimately quoted through Progressive.

Most Roads Lead to Progressive

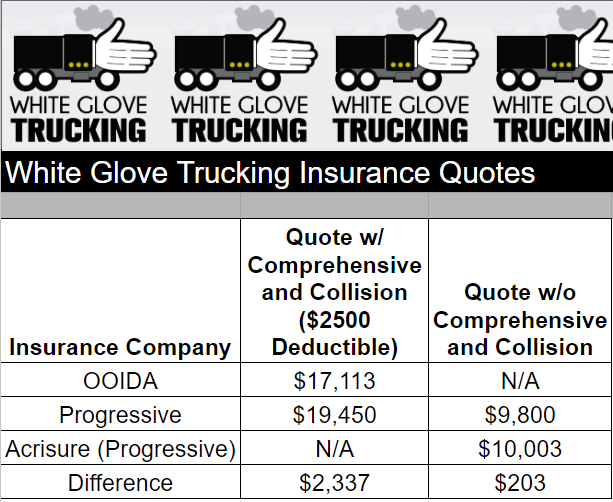

I was only able to get a quote on my own through two companies, Owner–Operator Independent Drivers Association (OOIDA) and Progressive. Farmers, through their commercial truck insurance subsidiary Kraft Lake, also ended up quoting through Progressive. My local agent managed to get a few quotes from other companies, but none could compete with Progressive’s pay-in-full option.

- OOIDA: This company has a nice mom-and-pop feel, like calling your local insurance agent. If you prefer a quaint hometown touch, they could be a good option. They required a down payment of about one month’s premium. However, they do not allow you to hire drivers until you have been with them for at least two years.

- Progressive: In contrast to OOIDA, Progressive has an automated system that eventually connects you to a representative, giving it a very official feel. The option to pay in full is a great feature if you can afford it.

- Farmers: They use a subsidiary, Kraft Lake, for commercial truck insurance, which ultimately provided a quote through Progressive.

- Acrisure: My local agent, representing Acrisure, found that none of their other quotes could compete with Progressive’s pay-in-full option. They also ended up quoting through Progressive.

Here are the quotes I received:

- OOIDA was $2,337 cheaper ($195/month) than Progressive for full coverage.

- Going through Progressive directly was $203 cheaper than going through an agent.

- Eliminating comprehensive and collision coverage saves $9,650 annually.

Why I Chose Progressive Through an Agent

I asked one of the agents I spoke with to explain the benefits of going through a broker instead of purchasing insurance directly from an insurance company. She provided a couple of reasons why using an agent might be advantageous:

- Flexibility with Multiple Insurers: When an insurance company drops you and you have an agent dedicated to one insurance company, as was my case with Great West, the relationship ends. In contrast, a broker can search multiple companies to find another replacement.

- Quicker Proof of Insurance: If I need to quickly send proof of insurance to secure a load, brokers can send those over more quickly than if I had to call an 800 number and wait on hold with a big insurance company.

I wasn’t sure how much the second point applied to me since I use all the big, digital brokers who manage insurance compliance through RMIS. In my experience, I have only had to send my insurance information once to RMIS and not worry about it again. So, this concern seemed a bit outdated, at least in my case.

I also spoke to a Progressive agent about my dilemma of whether to purchase directly or go through an agent. He informed me that Progressive agents do not earn commissions and that my premium would not increase if I used an agent. Agents are paid by Progressive receiving less, not by me paying more. He also mentioned that just because I went through an agent didn’t mean I couldn’t call Progressive directly if needed. I appreciated having this option, and his information was very helpful in making my decision.

Ultimately, I decided to go with Progressive and go through an agent even though it meant I would be paying an extra couple hundred dollars–$10,003 instead of $9800. I decided to go with an agent even though I would be paying an extra $200. They were local and I liked them and also liked the idea of having an insurance team. And I felt like they had done so much work for me already.

Liability/Cargo Only or Include Physical Damage Coverage

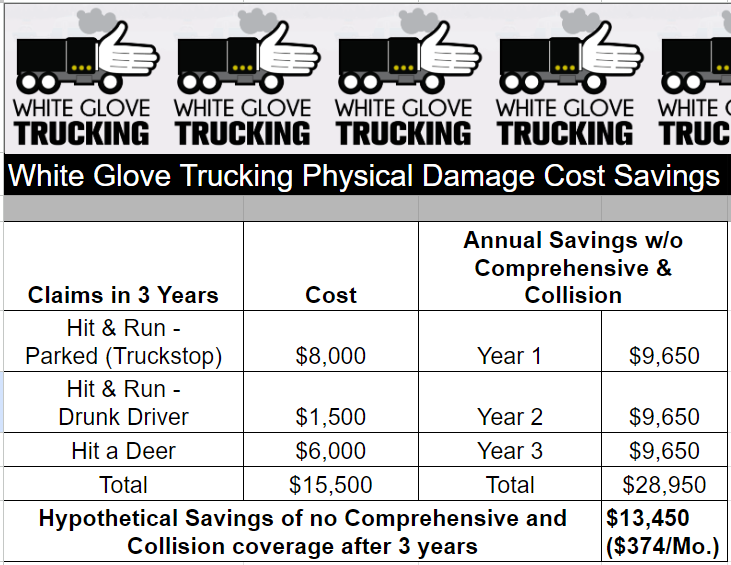

Learning to Limit Claims: Now that I have learned the lesson about how insurance companies will drop you if you make too many claims, I have to reconsider how I view my insurance in the future and also reconsider the types of coverage I need.

Identifying the Existential Risk: Because I don’t control the insurance company but need insurance to operate, the insurance company poses an existential risk to my business.

Reducing the Existential Risk by Limiting Claims: To eliminate, or at least drastically reduce, this risk, I will need to limit the number of claims I make. In my case, 2 of the 3 claims I made in three years were for incidents that were not my fault and unavoidable. However, just because the accidents were unavoidable doesn’t mean making the claim was unavoidable. It’s better to pay for small repairs myself and keep my business running than to nickel and dime the insurance companies to the point where I can’t get insurance at all.

Level 1 Adjustment – Raising Deductible to Trigger Point: So that brings me to my first adjustment. If I will only use insurance for high damage accidents, then I need to raise the deductible to save on annual premiums. For example, If I am only going to do a claim for something that cost, say, $3000 or more, then having a $1000 deductible is pointless. By raising the deductible to a level at or above what I’m willing to pay out of pocket, I can save on annual premiums while ensuring that insurance is only used for significant expenses.

Level 2 Adjustment – Reevaluate Insurance Coverage Needs: So then came my next revelation. I need to just totally reconsider the types of coverage I need. If I’m going to repair most things myself, except for super-large repairs, then I need to consider whether to have physical damage coverage at all or if I am willing to assume this risk myself.

Reviewing Past Claims to Estimate Future Ones: So I had 3 claims in 3 years for a total repair cost of $15,500. The annual savings in premium if I don’t get physical damage is $9650. Or about 29K over 3 years. So using this hypothetical example I would have saved $13,450 over 3 years by repairing everything myself. So you can see that just blindly getting all coverages might not always be the smartest bet.

Factor in Deductibles: Considering the deductibles, each incident cost me $1000 out-of-pocket. Therefore, even with physical damage coverage, I am still assuming a good portion (20%) of this risk.

Factor in Driving Style: The last thing I needed to factor into this decison is my special driving style called: Go Slow, No Macho, No Uh-oh

This means that I:

- Drive 54/55 mph

- Always yield to other drivers 100% of the time

- Never drive when tired or too long so that I lose my focus or my joy.

Given these figures, it is worth evaluating whether maintaining comprehensive and collision coverage is necessary, or if a more self-reliant approach to minor repairs could be more cost-effective in the long run.

Allow Time for Updating RMIS

My old insurance was set to expire on a Sunday, so I set up my new insurance on that Friday. Unfortunately, that wasn’t enough time to get everything in order with RMIS and all the brokers to be ready to roll Monday morning. Brokers notice the second your insurance expires but take a while to recognize that you have a new one set up.

I received an email back from one broker stating that because of the value of their loads, my $5,000 deductible was too high and that they require a cargo deductible of $2,500 or less. However, they also offered an alternative to avoid changing my insurance and still haul for them if I agreed in writing to cover the cost of the load if damaged:

“If you do not want to change the deductible we can accept a note for your account stating you will pay the $5,000 or the value of our shipment if anything happens to it in transit.”

Conclusion

In conclusion, my journey through the challenges of trucking insurance has taught me invaluable lessons that I hope can benefit fellow truckers and carriers. Understanding how insurance companies assess risk, view claims, and consider safety violations is crucial for not getting dropped. From my experience, it’s clear that proactive measures such as maintaining a clean safety record, utilizing tools like FMCSA’s DataQ, and carefully evaluating insurance options can mitigate potential pitfalls and save you money.