Introduction:

Starting a company is an exciting yet challenging endeavor. When I decided to venture into the trucking industry, I had little knowledge about purchasing a truck and securing financing. In this blog post, I will share my experience of buying the truck, describe the obstacles I faced during the financing process, and provide you with tools for making smarter purchasing decisions.

Buying a 3-year old truck with less than 350,000 miles

In 2021, the trucking market was booming and finding the right truck proved to be a challenge. I had no idea about how to select a truck, but I knew I wanted a late-model truck with relatively low miles. I soon learned that I didn’t have to worry too much about truck selection because this was the height of the trucking market in 2021 and there were very few available. If I located a truck, by the time I went to look at them they were already sold. After numerous unsuccessful attempts, I stumbled upon a truck that met my specifications at a rural dealership in Virginia.

It was a 2018 red international LT with 346,000 miles on it. Interestingly, it had been on the lot for over 6 months. The salesman told me that people had come to look at it but none of them had qualified for financing it (as I would soon find out why). Not really knowing what to look for, I did a pre-trip on the truck and took it for a test drive. It drove fine and I thought I was lucky to find this truck close to home when it didn’t seem like many were available. Fortunately, I managed to purchase it at a reasonable price of $77,500 just before the used truck inflation began.

Even with a good credit rating and ample downpayment, interest rates are higher for new venture commercial truck loans

This was a small, rural dealership that didn’t offer dealer financing. So the dealership put me in contact with a broker they use to help buyers find the best financing options. I provided 3 years of tax returns and a bank statement showing my balances for the prior three months. My personal credit score was about 750 and I had about $36,000 cash. I thought this would be more than enough to prove my creditworthiness and secure a loan with reasonable terms but I was wrong. The broker sent my information out to multiple lending institutions and each of them approved me and gave me an offer.

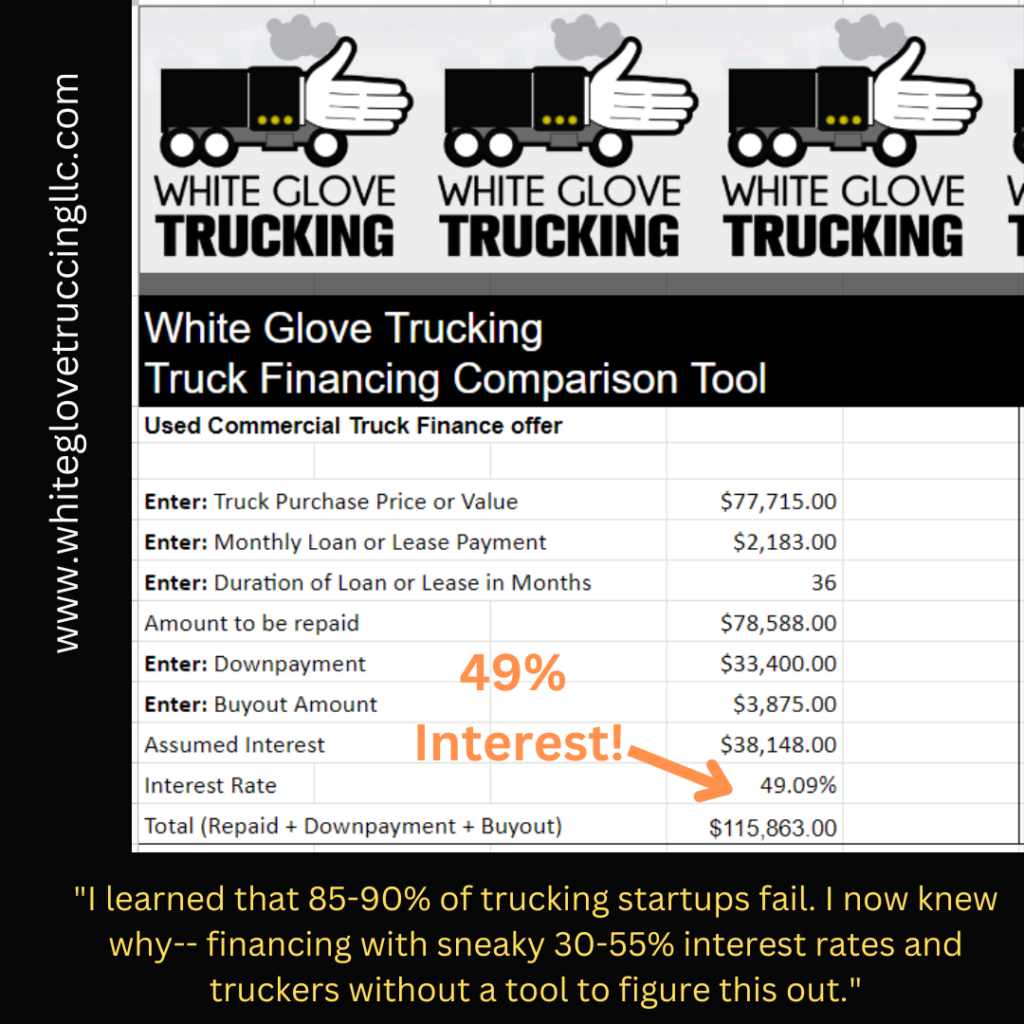

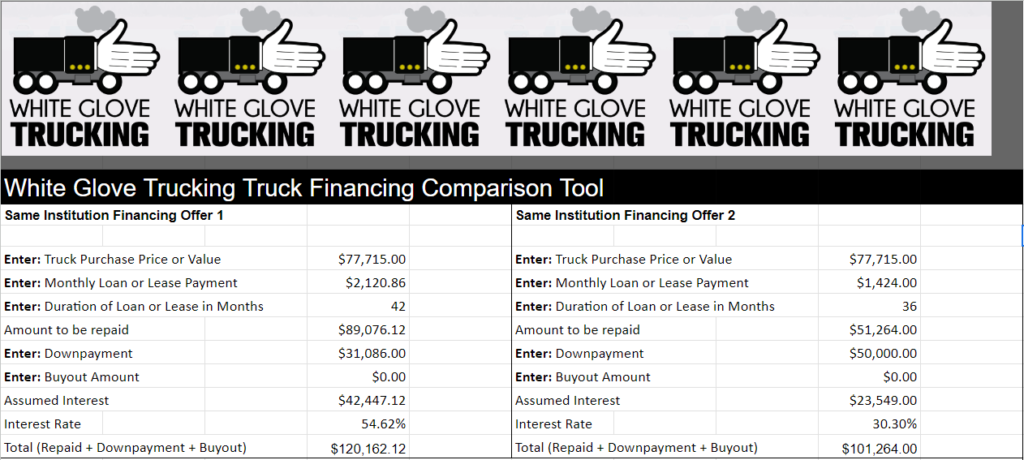

Comparing the different offers to figure out which was the best wasn’t easy. Instead of a loan format like I was used to when buying a car, the offers were in a lease format, which included a monthly payment amount but did not include an interest rate. Furthermore, they included different requirements and add-ons. For example, one company had a better rate but had a minimum loan amount of $120,000, much more than I needed. Another charged an additional $9,870 for “e.g., Underwriting and Docs, Registration, Third party referral services, etc.…” So to better analyze and compare the offers, I created the White Glove Trucking Truck Financing Comparison Tool. I used this tool to calculate the interest rate and the total amount paid at the end of the term. After plugging in the numbers, my calculation revealed that the interest charged on these offers ranged between 30-55 percent! It also became clear that, because each time my credit was run my credit score dropped, the offers were getting worse and worse. I later learned that because of the many credit inquiries during this process, my credit score had gone from 750 to 650.

Trucking Startups High Failure Rate Due to Sneaky High-Interest Loans

When I complained to the broker about the rates, he said these types of offers were typical for owners of new trucking companies due to lack of business credit, and that “you have to pay to play.” I was incredulous, and asked if other truckers were signing up for these offers. He said yes and that he had just finalized three of these the day prior. He further stated that in all the time since becoming a broker, I was the first person who scrutinized the terms this closely, and that typically truckers just see the truck and think about the revenue they can generate and don’t worry too much about the loan terms. While doing my startup research, I learned that 85-90% of trucking startups fail. I now knew why–financing with sneaky 30-55% interest rates and truckers without a tool to figure this out. This was my first experience with predatory practices found within trucking. In trucking, these types of practices are not uncommon so you have to make smart financial decisions.

“I learned that 85-90% of trucking startups fail. I now knew why– financing with sneaky 30-55% interest rates and truckers without a tool to figure this out.”

Reasons Why Some Lenders Refused to Lend to Me

A couple of loan companies had concerns about my qualifications and did not approve me. One refused to consider me because I had received unemployment insurance during the COVID-19 pandemic. A second asked if I had a business plan, how I planned to generate income, and if I already had contracts established. They were not impressed when I said I was going to be using the spot market. Lastly, one lender asked me if I would consider purchasing a day-cab instead of a sleeper truck because they were easier to finance.

One Lender Required I Borrow $100,000 Minimum

I decided to search for financing on my own as well. The only institution I found that would give me a loan was an institution known for being a last resort for people with bad credit. I even tried to sweeten the deal by telling them I had cash and that I would only need a loan of $25,000. But my cash didn’t matter. This institution would only give me the loan if I was going to finance both my truck and trailer so that the total loan amount would be at least $100,000.

One Lender’s Revised ‘Better’ Offer Was Still a 30% Interest Rate

You can’t trust what the lender says and have to run the numbers for yourself. One lender offered to give me a loan that resembled a traditional car loan, revising his prior lease offer. I became excited that someone finally understood what I wanted. Then he sent over the revised loan terms. After plugging the new numbers into the White Glove Trucking Finance Comparison Tool, I realized that despite the total repayment amount decreasing from $120,000 to $101,000, the interest rate was still 30%! I emailed him my calculations to ensure there wasn’t some mistake but I did not receive a response.

Borrowed from retirement account to start my trucking company

Before embarking on my entrepreneurial trucking journey, I was working as a seasonal employee for the Internal Revenue Service assisting individuals with their tax returns and stimulus payments. As my seasonal position drew to a close, the IRS offered me the opportunity to extend my employment, but deep down, I knew that I wanted to pursue my dream of starting a trucking company. So I got a $50,000 loan from my federal 401k retirement plan.

The loan had certain conditions attached to it: I had to be actively employed to qualify, and if I were to leave my job, I would have a mere 90 days to repay the loan. Given my status as a seasonal employee, I technically remained employed until the next season began. Only if I declined employment at that time would I be officially terminated. This meant I had approximately six months until my active employment ceased, followed by an additional 90 days to repay the loan without incurring penalties(10% early withdrawal fee and approximately another 20% in taxes). Consequently, I began my trucking company in a race against time to make enough money to repay the loan.

Choose paths that enrich your life and work hard to make your own luck

My job at the IRS was entry-level and was a lower position than my prior government job, so when I was offered the position I wasn’t sure if I should accept it. The decision was made even harder because, at that time, I was receiving unemployment insurance due to the COVID-19 pandemic, and the job was going to pay less than what I was receiving on unemployment. So I would actually receive more money by doing nothing. Nevertheless, I did take the job and it was only because I took that job, that I was able to get the loan that helped me begin my new trucking company. This taught me a valuable lesson, which is to always choose the path of doing rather than not doing; choose the thing that offers the chance to gain an experience that will enrich your life. In choosing to be active in life instead of passive, I opened a door that led to a window of opportunity. In taking action, I believe I made my own luck and created a greater chance for opportunity to come into my life.

“Choose the path of doing rather than not doing; choose the thing that offers the chance to gain an experience that will enrich your life.”

Don’t start your trucking company with your tank empty; you will need an emergency reserve fund for repairs and any other mishaps on the road.

Purchasing my truck and trailer with cash left me with zero capital. I didn’t want to start a business with zero capital so I had to decide to either max out my credit card for $20,000 and keep $20,000 cash or use all of my cash and have my credit card as the reserve. I chose to use the credit card and keep the cash as a reserve. Luckily, I did not have any major breakdowns before I could save up more cash reserve, but it was nice to have cash as insurance in case I needed it.

Conclusion

In conclusion, the process of starting a trucking company and purchasing the first truck was filled with challenges and valuable lessons. I initially faced difficulties in finding a suitable truck and the financing process proved to be complex, with high interest rates and confusing terms. I created a tool to help during this process that I hope will empower other drivers to make informed decisions when purchasing their trucks. I hope my experience provides valuable insights and advice for others considering a similar path. Your initial truck purchase is crucial to your success so it’s important that you get this right!