Making the decision using a detailed 5-year revenue projection

Frequent repairs motivated me to consider buying a new truck

I was sitting in my hotel room and my truck was in the shop AGAIN. This was my second trip to the repair shop in three days. I had recently been towed because my truck refused to start and had been late to the delivery. Because I was late, I had to reschedule the delivery, and the next available appointment wasn’t until almost a week away. So in the meantime, I would have to sit, wait, and not earn any money. Also, equally if not more important than not earning money was that these issues were adding stress to my normally peaceful, enjoyable drives. It was time to re-consider buying a new truck.

In the past, when I became frustrated at needing another costly repair, I had attempted to calculate the return on investment of buying a new truck to see if it was worth it. But because I usually just performed a casual computation in my head and never actually wrote it down, the calculations always overwhelmed me and they never amounted to anything. There were just too many variables to consider when trying to compare whether to keep my current truck, buy a new truck, or lease a new truck.

Well, this time was going to be different. I had motivation. Sitting in the hotel had given me the time to reflect and review the business performance for the first half of 2023 and it wasn’t pretty. I had driven approximately 54,000 miles, the truck was up to 568,000 miles, and I had spent close to $20,000 on repairs in six months. This equated to about 37 cents per mile! After this sunk in, I pulled out the computer and got working on something that would allow me to lay out all of the information required to finally make an informed, data-backed decision about whether to continue running and repairing the old truck or buy or lease a new one.

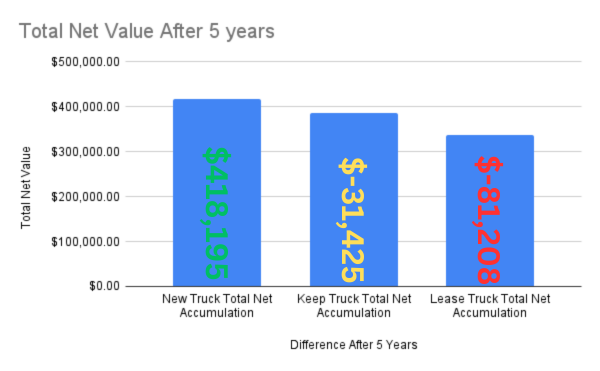

The result was a spreadsheet that showed the amount I could expect to earn and accumulate over a five-year period, depending on which decision I made. You can probably guess from the title of this post which option was best for me and which I ultimately chose. But the best decision for me may not be the best one for you. So let’s take a look at what I learned and maybe this information can help you if you are trying to decide whether to buy a new truck.

5-Year estimate comparing three options: Keep my old truck, buy a new truck, lease a new truck

*Please email me at [email protected] to purchase a copy of the spreadsheet.

5-year estimate: what I learned

1) There is more annual revenue and total annual net value from a new truck purchase from year 1. But it will take several years to recoup and overtake the of level of cash I would have had if I’d kept the old truck.

- More Cash – Year 5

- More Assets – Year 4

- More Total Accumulation – Year 1

Therefore, if you are on the fence between buying a new truck cash and keeping your older truck, it’s not really that big of a deal financially to wait to make the decision. Also, if you aren’t sure you will want to drive another 4 to 5 years then it could be smarter financially to keep your old truck because it isn’t until year 5 that you actually have more cash from purchasing a new truck.

2) The data showed that despite the high maintenance costs, I would have saved more money keeping the old truck for five more years rather than leasing or financing a new truck at the interest rates I was being offered. Therefore, it is typically better to keep your old truck and save to buy your new truck with cash rather than lease a new truck. Based on this knowledge, the only time I would lease a truck is if I had a large repair I could not afford to pay that was going to put me out of business completely. In this instance, a leased truck would at least allow me to stay in business and have a reliable truck to use. I would then work really hard to pay off the truck and save a repair fund before the truck ages and the cycle of repairs starts all over again.

3) If I was buying this truck for a driver instead of for myself the decision would have been different. If this were the case, I would have either kept the old truck or financed/leased a new truck. When dealing with a driver, I think it is probably better to save my cash and finance or lease the truck to let the bank assume some of the risk.

4) Even though the numbers show that you can make almost as much with your old truck as you can with a new truck, buying a new truck was an easy decision for me. I really don’t like performing repairs, and I also don’t like the stress of potential breakdowns and late deliveries.

5) My truck insurance actually increased less than I thought it would. I initially thought that since I was doubling the value of the truck being insured, then my insurance would also double. This assumption was wrong and my insurance only increased by about $80 per month.

Buying a new truck and developing a strategy to optimize my earnings from trucking

I wished I had either bought a new truck sooner or been more strategic about doing less repairs prior to trading in the truck

I was hoping to get more from my trade-in than $27000 but what frustrates me more than the trade-in amount is how much money I spent fixing up the old truck before making the decision to buy the new truck. 2023 is a depressed market for used trucks and the trade-in value is not something I have control over. However, I did have control over buying a new truck sooner. The things that need repairing on these trucks follow a pattern. Why didn’t I see it? Could I have better researched the things that go wrong between certain mileage ranges? Multiple owner-operators have told me about replacing their turbocharger so I had that on my radar. But why didn’t I take that knowledge and think bigger and research all my major parts and the probability of when they would need replacing? This is so important because I really wish I had not put $20,000 into the truck the first half of the year just to trade it in at a discounted rate. I wish I would have established some kind of marker earlier that would have triggered me to sell. All of the money I put into the truck only has value to me because it was going to help me continue to earn money, but only if I was keeping the truck. None of that money I put into it seemed to have value when trading it in. Basically, my truck was worth $27,000 and I put $20,000 into it and it’s still worth $27,000. Ugh!

Ask yourself if a cooler more comfortable truck is worth $1000/mo. or $60K after 5 years

I thought I would feel more sentimental about trading in the old truck, especially given as many conversations I’ve had with it haha! But I wasn’t. I think it’s cool when truckers really dote on their trucks, lavishing it with all the chrome and gizmos. But I also think there’s a benefit to simply viewing the truck as a tool and as a means to an end. I feel like when viewed this way you’re less likely to make bad financial decisions concerning the truck. For example, I fantasized about what it would be like to have gotten a more expensive truck with more creature comforts inside and better curb appeal. But then I took the extra $60,000 it would cost to get a really nice truck versus a base level truck and I divided that $60,000 by 5 years and it equaled $1,000 a month. Is $1,000 a month worth the creature comforts and the attention grabbing a better truck offered? For me it isn’t but for some it most definitely is. This is a personal decision and only you can make it. However, I think you should at least ask yourself this question when considering your new truck. I personally would rather add $60,000 to my ROI at the 5-year point.

Buy new, warranty the hell out of it, sell, repeat

While getting my truck repaired one service manager I spoke with was particularly frank about repairs and about the best strategy for purchasing a new truck. When I expressed concern and frustration about all of my recent repairs, he said that repairs are simply inevitable with an aging truck and that, optimally, I would sell the truck prior to this stage. He said the ideal way to buy a truck is buy new and load up on every conceivable warranty, extending them all out to 5 years/500,000 miles. Next, the secret is not to be like most drivers and wait until the warranty runs out to sell the truck. Instead, sell the truck at 400,000 miles while it still has a good amount of warranty left. He said I would get a much better resale value this way.

Consider future repair costs early on

My favorite thing about having my first new truck is having the ability to treat it carefully from day one. The only miles on the truck were the miles the driveaway driver put on it delivering it from the port in Texas to Jacksonville. I have mentioned before that when I drive, I always need to think about my future self. Well, when I am driving my new truck, I have to think about my future truck. I believe that when I am driving miles 1000 to 100,000 I need to think five years down the road to when I will be driving mile 400,000 to mile 500,000. I believe the actions I take now could make a big difference between what I have to spend on the truck, especially during that crucial period right before I intend to trade it in.

Steps to adding a second truck

Adding a second truck was much easier than adding the first truck when I was also establishing my operating authority. Adding the second truck was done all through my state’s DMV and did not involve FMCSA. Here are the steps and a few issues to look out for.

Adding a second truck checklist:

- Call your insurance company early on and ask them what the additional cost will be so you are not surprised.

- Title the truck in your home state if you buy out of state.

- Transfer the tags from your old truck to your new truck. I had to send my Schedule 1 for my IRS Form 22901 to VA DMV before they would transfer the tags.

- Get new IFTA decals. I waited until after I had the truck to do this but you don’t have to as they aren’t associated with a particular vehicle.

- Call your insurance company and set up the insurance the day you purchase the truck

- Heads Up: Wiring the money turned out to be a big hassle. There was a daily limit and my attempts kept getting rejected and my bank account was flagged as fraud and locked. Ultimately, it took several days to wire the money.

- Research the engine parameters desired (speed limiter, idle shutdown, etc.) and negotiate with your salesman to get this free. Otherwise, later it will possibly cost you a couple hundred dollars.

- Get New York HUT2 sticker after you have the VIN number and temp plate.

- Get logo, DOT number, and truck number printed on truck

- Get extra keys made, if needed.

- Print new insurance certificate and IRP card for compliance binder inside truck

Tracking the return on investment over time

I plan to do additional follow-up posts to this one to track the accuracy of my estimates. Here are a few ideas of what I may be able to track. If you are interested in seeing this data don’t forget to check back in at the 1,2,3,4,and 5 year mark to find out!

Ideas for a new truck 4-year follow:

- Track total cost versus total revenue

- Total annual maintenance cost

- Warranty cost versus how much I actually use

- Others TBD

Notes:

General assumptions for estimate:

1) I derived my revenue calculations from my business performance for the first half of 2023. This was a down market/freight recession, so revenue numbers are conservative (hopefully). Therefore, any spot market correction upwards could make my projected revenue and accumulation amounts larger.

2) I did not include depreciation tax savings into the calculation. However, if I wanted to approximate it, I would take 15% of the annual depreciation amount of $31200 which would equal $4680 per year. This amount times 5 will give you a total additional $23400 after five years.

Specific Row descriptions and assumptions for estimate:

Row 6, Keep Truck Value – Used actual trade-in value for truck. Assumed value would decrease by $1000 per year for the next five years

Row 9, Net Income before repairs & fuel – Used actual net income through June for 2023 and multiplied by 2 to estimate the full year’s net income.

Row 10, Repairs – Used actual repairs through June 2023 to estimate the full year.

Row 11, Fuel Costs – Used actual fuel costs through June 2023 to estimate the full year.

Row 18, New Truck Value – Used actual purchase price. Assumed 20% depreciation over 5 years

Row 21, Net Income before repairs & fuel – Used actual income from Row 7 and assumed a 15% increase due to better uptime.

Row 22, Repairs – Used my actual repair costs for the old truck to estimate years 4 and 5. Used Team Run Smart guideline3 to determine my actual costs were 2.5 times their 2012 estimate. Multiplied Team Run Smart guideline by 2.5 to estimate years 1, 2, and 3. All years assume 110,000 miles driven annually.

Row 23, Fuel Costs – Assumed 10% reduction from fuel costs of the old truck

Row 24, Additional Insurance Costs – Used actual insurance cost increase

Row 30, Assumed no value at end of the lease term. However, this may vary depending on the lease.

Row 37, Lease Payment – Used actual value of truck plus 15% interest to determine lease amount for five-year term.

1. Heavy Highway Vehicle Use Tax: Anyone who has registered or is required to register a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more in their name at the time of first use on the public highways during the reporting period must file Form 2290, Heavy Highway Vehicle Use Tax Return.https://www.irs.gov/businesses/small-businesses-self-employed/trucking-tax-center#:~:text=Office%20for%20information.-,Heavy%20Highway%20Vehicle%20Use%20Tax,Highway%20Vehicle%20Use%20Tax%20Return.

2. HUT Definition: The laws of New York State are unique for heavy vehicles. The state imposes a highway use tax, or HUT, for automobiles weighing over a certain amount. The tax fluctuates according to the weight and purpose of the vehicle. https://www.tax.ny.gov/bus/hut/huidx.htm

3. Team Run Smart – https://www.teamrunsmart.com/articles/truck-smart/maintenance/july-2012/how-much-should-you-put-away-for-maintenance