Introduction

In a previous post, I documented the purchase of my new truck and stated that I would do a performance follow-up. This followup delves deep into trucking profitability. In this comprehensive analysis, I explore nuances between new and used truck profitability, profitability tiers in the trucking industry, and strategies to optimize success as an independent trucker. Join me as I present insights revealed by this comparative analysis.

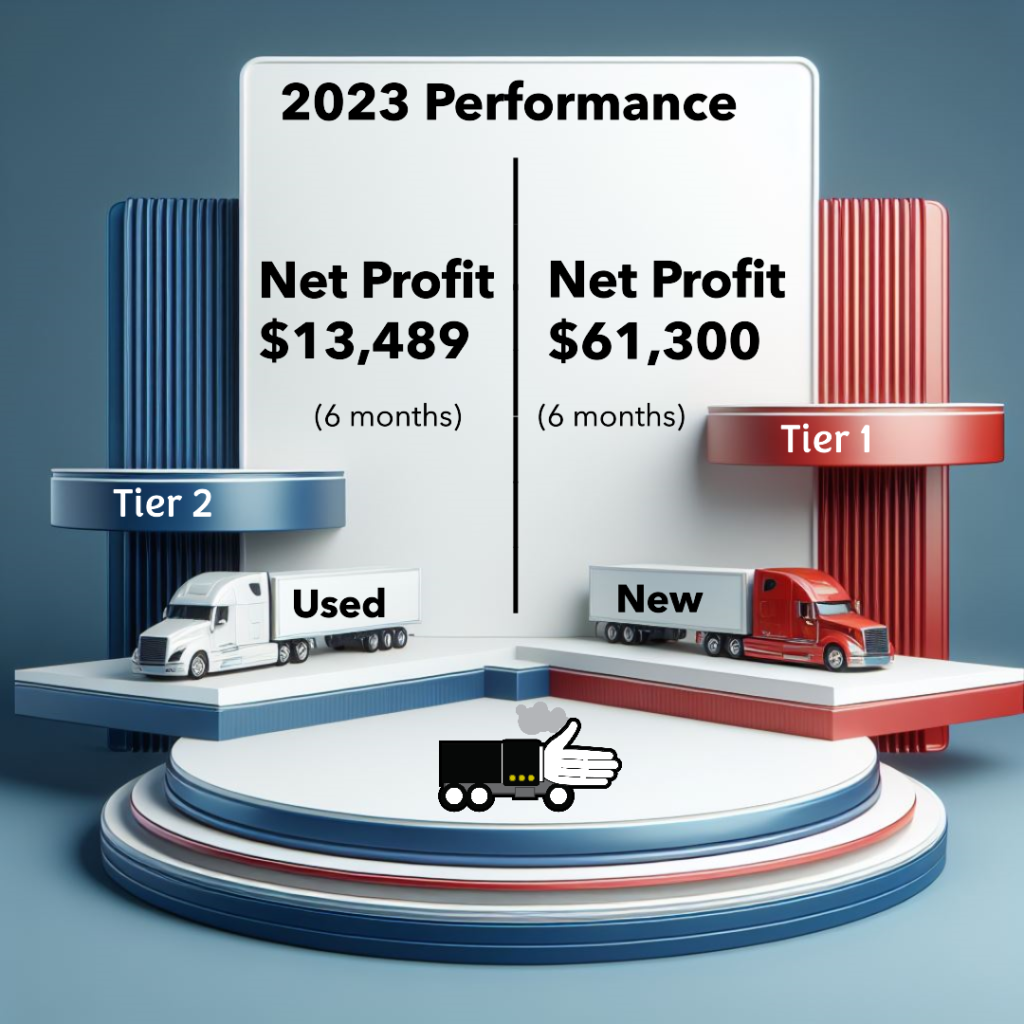

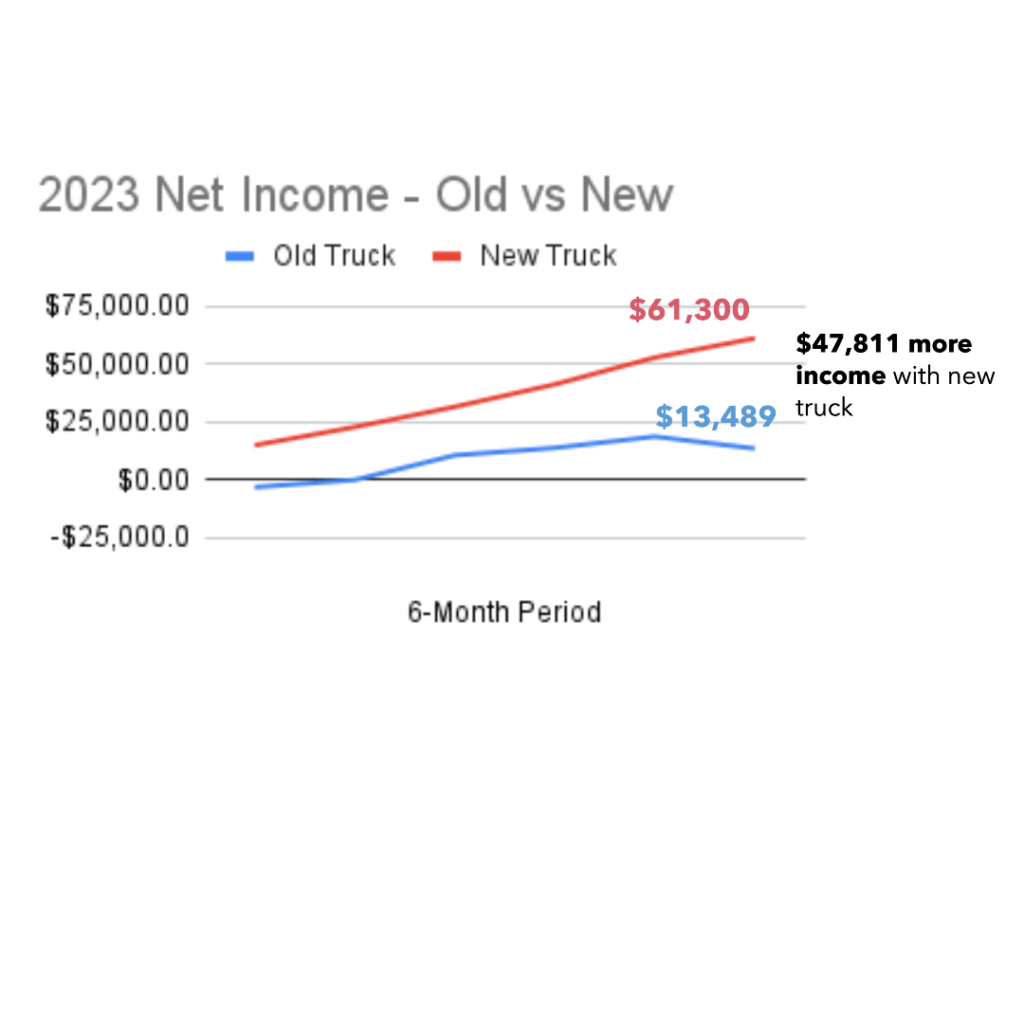

Profitability Comparison – New Truck vs Old Truck

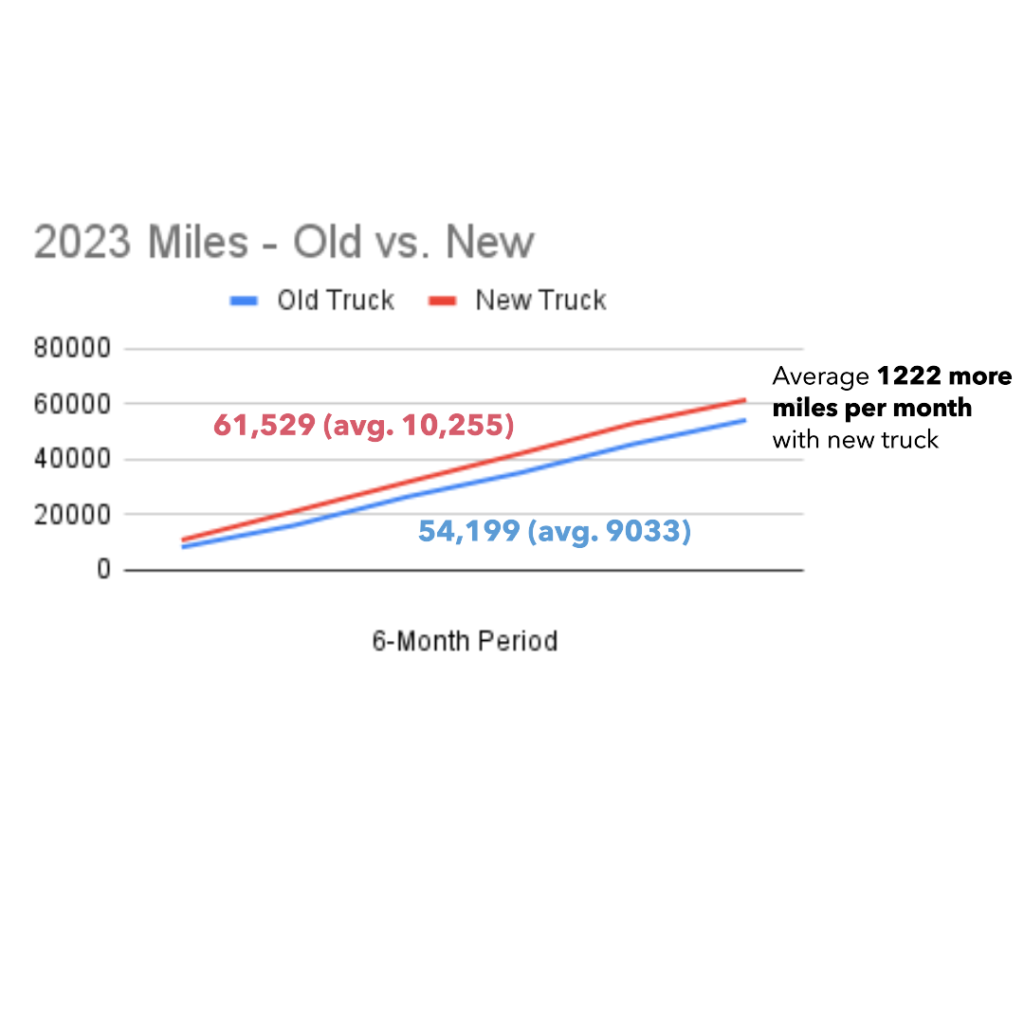

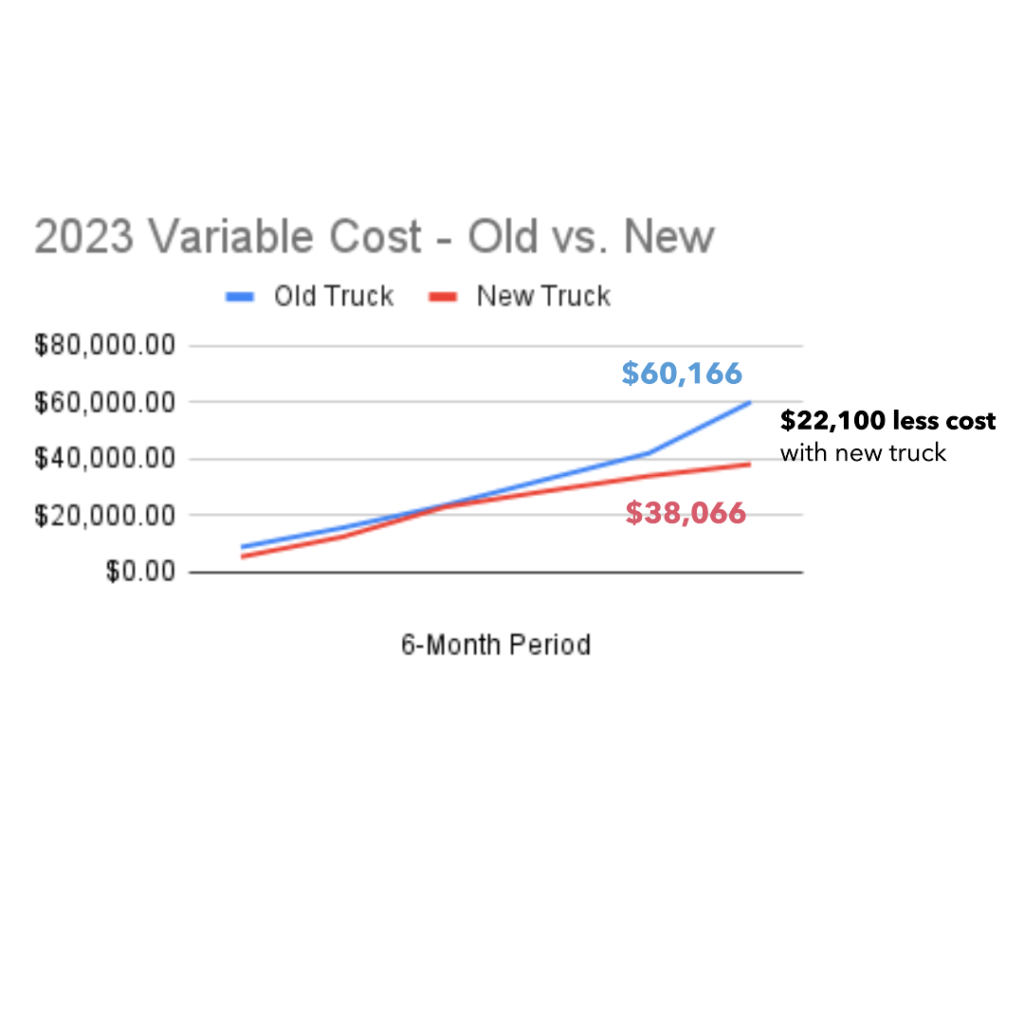

This table is my profit and loss annual summary for 2023 subtotaled by the two trucks I operated during the year. The data for the first 6 months represents the operational performance of my old truck and the data for the last 6 months represents the operational performance of the new truck. I bought the new truck on July 5, 2023 and so, for analysis purposes, I could not have timed the purchase better. This comparison highlights a crucial finding: new trucks yield significantly higher profits. This is something that many truckers already know but it’s nice to see the data to corroborate it. In my case, it was $48,711 more profitable in a 6-month period! This finding underscores the importance of investing in newer equipment for enhanced profitability in the long run.

Old Truck:

- Year/Make/Model: 2018 International LT

- Miles during period: 514535 – 568734

- Engine: Cummins X15 450hp

New Truck:

- Year make model: 2024 International LT

- Miles: 1650 – 63179

- Engine: Cummins X15 Efficiency Series

Driving style:

- Speed: Typically maintained between 55-58 mph for optimal efficiency.

- Where I procure loads: Utilized various load boards such as Uber Freight, Convoy, CH Robinson, JB Hunt, Coyote, Echo, and RXO.

- Where I travel: All 48 states

- How I fuel: Mudflap App

- How I get maintenance done: Undertook maintenance wherever feasible during over-the-road trips.

- Weight Limit: No strict preference for load weight, though a lighter load was favored when other factors were equal.

Variances Between New and Used Truck Performance

Fuel cost: Fuel cost per mile is pretty much identical. Not really surprising since it was the same truck with the same engine. It is nice to know that you don’t get a drop-off on fuel mileage as the engine ages.

Fixed Costs: Comparing fixed costs between the first and second half of the year may not accurately reflect the impact of the new truck due to skewing toward the beginning of the year.

Unveiling Profitability Tiers: Comparing Performance Between New and Used Trucks

The data from my trucking operations in 2023 reveals distinct tiers of profitability based on the condition and maintenance requirements of the two trucks. I categorize these tiers as Tier 1 for the new truck and Tier 2 for the old truck, each representing different levels of profitability and operational challenges. In my experience, once the truck hits Tier 2, and this repair process starts, it seems like it continues to happen month after month. Here is a description of each tier:

Tier 1:

- Profitability Levels: Over 50%

- Description: Tier 1 profitability characterizes the performance of a new truck that requires minimal maintenance, leading to higher uptime and more consistent monthly miles.

- Financial Considerations: With a new truck financed with cash and no interest, I experienced monthly profits ranging from 42% to 68%.

- Operational Benefits: The higher uptime and consistent performance of the new truck allowed for smoother operations and increased revenue potential.

- Survivability Rating: Great – By driving consistently and avoiding costly mistakes, surviving should be no problem.

Tier 2:

- Profitability Levels: Under 15%

- Description: Tier 2 profitability signifies the performance of a used truck that is fully paid off but requires significant maintenance due to higher mileage.

- Financial Challenges: Despite being free of loan payments, the higher maintenance costs and associated downtime led to profitability levels below 15%.

- Operational Challenges: Operating under imminent breakdown conditions heightened stress levels and reduced revenue potential.

- Survivability Rating: Precarious – Avoiding costly mistakes is crucial because they can be fatal in Tier 2.

Understanding Profitability Tiers Helps Determine When to Buy a New Truck

Now that we understand the concept of profitability tiers in trucking, let’s explore how this knowledge can inform our decision-making process when it comes to purchasing a new truck.

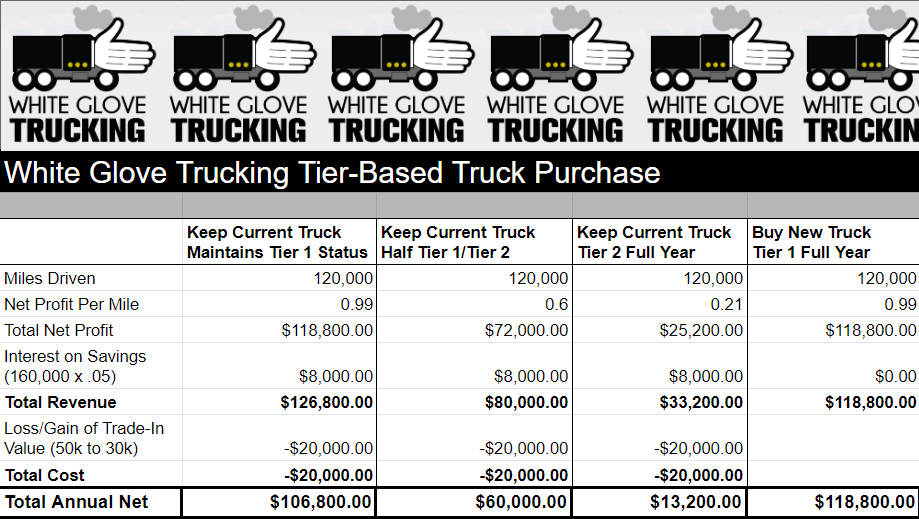

Imagine you have 360,000 miles on your current truck, and you’re debating whether to trade it in for a new one or continue driving for another 120,000 miles over the next year. By leveraging the rates per mile obtained for each profitability tier, we can conduct a comparative analysis to determine the best course of action.

Assumptions:

- Trade-in value at 360,000 miles: $50,000

- Trade-in value at 480,000 miles: $30,000

- Interest rate on savings: 5%

The analysis reveals that while continuing to operate the current truck and accruing interest on savings may result in the highest revenue at $126,000, the decrease in trade-in value outweighs the interest earned. As a result, purchasing a new truck may actually lead to a higher net accumulation for the year.

However, it’s essential to consider the inherent risks associated with continuing to operate the current truck. Entering Tier 2 profitability could significantly decrease revenue, potentially offsetting any financial gains from delaying the purchase of a new truck.

While the decision to buy a new truck may seem financially prudent based on the analysis, it’s crucial to weigh the risks and benefits carefully. This means also looking at the long-term profitability and sustainability of your trucking business.

Buying Fewer Trucks Can Save Money in the Long Run But Not Without (Tier 2) Risks

The above analysis helps to understand whether a truck purchase decision makes sense in a given year but if it were that easy I would just buy a new truck every year. I also need to consider the long-term costs of reinvesting in equipment.

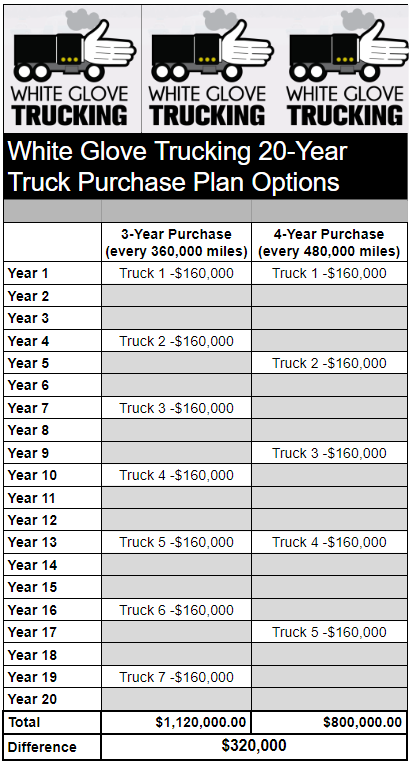

For example, let’s say you trucked 20 years. Here’s the difference between having a 3-year repurchase plan versus a four-year repurchase plan.

On a 3-year plan, you buy a new truck every 360,000 miles. On a 3-year plan you’ve bought seven trucks with the last truck being bought in year 19. On a four-year plan, you’re buying a new truck every 480,000 miles. On a four-year plan you’ve bought five trucks with the last one bought in year 17.

The 4-year plan allows you to buy 2 fewer trucks, saving $320,000 over the 20-year period. But you’ve increased your Tier 2 risk on 5 occasions, once for every year 4 during that 20-year period. I’ll have to play it by ear when it comes time to purchase but if I feel like my truck is doing really well, which hopefully will be considering my conservative driving style, then maybe I’ll go the extra year. Also, I doubt the cumulative maintenance costs performed in each year 4 will add up to be more than $320.000.

In closing, strategic truck repurchasing is about finding the right balance between maximizing current profitability and minimizing future costs. It involves weighing the decision to postpone the purchase of a new truck, risking Tier 2 status, against the potential savings of avoiding additional truck purchases in the future.

Trucking Classism and the New Truck/Used Truck Profitability Gap

The tiered nature of truck profitability reveals that there is a sort of classism in trucking. And it’s not what you typically think of in terms of the traditional hierarchy of company drivers, lease operators, independent owner operators, and carriers. Well, maybe that’s a part of it but that’s a story for a different blog post. The classism I’m referencing is based on the truck-based, glass ceiling of profitability relating to the distinction between the bigger carriers versus the independent owner operators.

This is how it works. The big carriers buy new equipment, run it and use that equipment during its most profitable Tier 1 life cycle. They then sell, trade-in, and hand down that equipment as it enters its less profitable Tier 2 status to owner-operators or aspiring truck drivers in the market for a used truck. The bigger carriers need owner-operators to buy this used equipment. This is a part of their reinvestment and profit structure. Well, it’s time for this cycle to change. We owner-operators cannot continue to be used in this way. No more bottom feeding; no more Tier 2.

Navigating the Dilemma: Challenges of Buying Used and New Trucks in Trucking

While the discussion so far has shed light on the pitfalls of buying used trucks and the advantages of purchasing new ones, the reality is that neither option comes without its challenges as buying a new truck is not a walk in the park. I have written in the past(here and here) about how hard it is to get a loan in the trucking industry, and even if you manage to obtain it, the exorbitant interest rates can place your business’s survival in a precarious position. The tiered profitability model likely contributes to these high-interest rates, as lenders perceive increased risk associated with trucking investments.

In fact, now something my banker confided to me is starting to make sense. He said that it was easier for him to finance five new trucks than one used one.

So, it seems that regardless of whether you opt for an old or new truck, you’re caught between a rock and a hard place, unless you have the means to pay cash upfront. Here are a couple of alternative methods, but first, one method not to try.

Tiered Profitability Is Why You Shouldn’t Lease Purchase

Now let’s look at a lease purchase program through the lens of tiered truck profitability. Let’s say you lease a new truck and you run hard for four years to make the payments and take ownership of the truck. You’ve just made the lease company tons of money because you have to run so hard in order to make those payments. They got a dedicated hard worker for the 4 years that the truck had optimal profitability. Now they get to hand it off to you just at the point where the truck’s profitability is declining. Sadly, this is actually the best-case scenario. The worst case scenario is you aren’t able to keep up with the payments and you walk away not owning the truck or in debt to the lease company.

Based on the people in lease programs that I’ve had the opportunity to talk to, the relentless amount of driving you have to do just to stay afloat in those programs would leave very little Tier 1 profitability left in the truck once it’s yours. If you absolutely have to do one of these programs, make sure you’re going to own the truck after three years, no more than four years, or the maintenance cost will probably be so high toward the end when the truck enters Tier 2 profitability that you can never quite get there to ownership.

Also, trucking is a very dynamic enterprise and things will always happen out on the open road that will prevent you from driving 100% of the time. You will not be able to drive day in and day out week after week month after month without something occurring. If the lease program is set up so that any time you take a break you get behind and in the hole, then you will not be successful in that program and you will eventually be in a hole that you will never be able to drive your way out of.

A Freedom Deferred: Company Driver Strategy

So used trucks have poor profitability, financing new trucks has too much interest, and leasing is a no-go. What’s an ambitious, freedom-seeking trucker to do when you are starting from Zero? Well, this may sound like anti-freedom sacrilege but hear me out. Given all these obstacles, my advice would be to work as a company driver while saving aggressively for a new truck and trailer. The key to this strategy is to drive with a defined purpose, laying the foundation for success and the eventual achievement of independent ownership.

In my first year at Knight Transportation while making 42 to 46 cents a mile I was able to save roughly around $25,000. Starting from zero I would have had to work 7 to 8 years before I was ready. Starting pay for new truckers has increased since 2018 so perhaps you can do this even sooner, but I will use my experience and numbers as a conservative estimate.

I know what you are thinking, 7 to 8 years sounds like a really long time and it is. But working 7-8 years as an on-ramp to likely success for your trucking company is much better than jumping into it too soon with a used truck that gives you the typical “9 of 10 trucking companies fail in the first 3 years” success rate. Imagine the alternative of treading water in a used truck or lease, struggling for a few years to make anything and then the truck finally dies. In that scenario, you’ve wasted 3-4 years with nothing, or worse, debt to show for it.

Here is a better plan:

The absolute key thing to this whole plan would be knowing from day one that the goal is to ultimately own my own trucking company and run independently. When I started, I had no clue I would ever start my own trucking company so I didn’t make the effort to do things that would have made venturing out on my own much smoother and more profitable. Knowing this, I would have taken the following steps throughout the 7 to 8 years that I worked for the company.

- Saving Money – Drive for 7 to 8 years saving $175,000 to $200,000 to purchase a new truck and trailer or as a downpayment on a small fleet.

- Learn Maintenance – Every time I had an A or B service, instead of just going to chill in the terminal, I would have gone into the trucking company’s shop and helped the mechanic work on my truck. This way I would learn basic truck maintenance skills.

- Network at Shipper/Receivers – I would have talked to all of the personnel of the places where I delivered and picked up. I would have tried to make connections and nail down future contracts.

- Build Driver Network – I would have networked and collected the names of people I thought would make great drivers.

Once I had saved the money, if I had contracts and drivers set up, then I would have used the money as a down payment for a loan to purchase three to five new trucks. If I didn’t have the contracts and people set up, or I didn’t want to go that route, then I would buy myself a new truck and trailer and run for myself.

A 7 to 8-year plan is not unreasonable for going from $0 in the bank to owning a trucking company with a small fleet. It is better to be a spoke in the wheel working as a company driver for a predetermined amount of time while orchestrating the plan and saving to buy a new truck, rather than perpetually cycling through Tier 2 used trucks. If it turns out you love truck driving or can at least love it for 7 to 8 years then there’s virtually no risk as you will be doing something that lets you happily explore the country while you save. If it turns out you don’t like truck driving then you will have to determine if 7-8 years is worth sacrificing if it lets you become a fleet owner later on.

I think the only exception to this plan would be another hot historical market like the one after the pandemic. If that ever happens again, I would at least consider the risk/reward of jumping in even under less-than-ideal circumstances (i.e. with a Tier 2 truck). If you decide to leap in, just drive hard and save as much as you can.

Truck Independently Retire Early (TIRE): Using Retirement Savings to Jumpstart Success and Happiness

This strategy may not be for everyone, but if you have retirement savings, using it to buy a new truck could be a good move. Before I started my trucking company, I would have never even considered using my retirement savings for anything other than retirement. However, as a trucking company owner, I found that tapping into my retirement savings offered both practical and happiness-related benefits. From a practical standpoint, due to the extra truck depreciation during the year of purchase, I was able to pay very little taxes on the retirement savings I withdrew. As a result, I decided the 10% penalty I would have to pay for taking my retirement savings early was worth it. As a nice bonus, when doing my taxes I learned that the 10% penalty is tax deductible.

However, the decision to utilize retirement savings wasn’t solely driven by practical considerations. I also found profound happiness in the freedom and fulfillment that trucking independently provided. In essence, trucking felt like retirement to me—a sentiment that inspired my Truck Independently Retire Early (TIRE) Movement.

This shift in perspective opened me up to being okay with using my retirement savings. Rather than saving for some distant future, I realized that I was already living my retirement dream through trucking. Imagine having to pay $200,000 to invest in a ‘job’ where you make $100,000 a year to embark on epic road trips every day. The notion of needing to save for future bliss faded away as I embraced the joy and profitability of trucking.

My TIRE Movement embodies this philosophy, aiming to empower truckers to create fulfilling and profitable trucking careers that feel like retirement. By sharing insights and strategies for making trucking enjoyable and profitable, I hope to inspire others to embrace the freedom and fulfillment that trucking can offer.

From Tier 2 Citizens to Trucker Royalty: How Independent Truckers Can Have the Best Profitability in the Game

Typically, newer, Tier 1 trucks are reserved for either larger carriers or smaller carriers and independent owner-operators paying high interest rates. So our profitability as the small guy is handicapped from the start. But if an independent owner-operator takes a page out of the large carrier playbook and buys a new truck cash, then they can reap some of the best profits to be had in trucking by combining the large carrier approach to truck purchasing with independent owner-operator operational prowess.

Independent owner-operators have a unique advantage when it comes to managing costs at the micro level. With a keen eye for detail and a hands-on approach to business operations, savvy truckers can effectively control fuel costs, implement preventative maintenance measures, and handle back-office tasks without incurring overhead expenses. This level of cost control enables them to optimize efficiency and profitability in ways that larger carriers simply cannot match.

They can also respond more quickly to environmental issues that may affect pay rates at a particular moment by avoiding depressed markets and gravitating toward hot ones. In essence, by combining the strategic purchasing power of larger carriers with the operational agility of independent entrepreneurship, truckers can transcend the limitations of Tier 2 profitability and emerge as Trucker Royalty in the realm of profitability.

Conclusion: Grateful and Humbled by this Deeper Understanding of Our Beautiful Yet Complex Industry

Reflecting on the insights gained from understanding tiered profitability in the trucking industry, I am humbled by the role that luck has played in my own journey as a trucking company owner. Looking back, I realize how fortunate I was to have experienced nearly three years of successful operation, and I am grateful for the series of fortunate circumstances that contributed to my business’s survival.

First, I was fortunate that my first used truck still had approximately a year of Tier 1 profitability remaining when I purchased it, allowing me to capitalize on favorable market conditions. Second, I was fortunate the timing of my entry into the industry coincided with what would later be recognized as the hottest trucking market in history, further bolstering my business’s success. All this enabled me to purchase a new truck within 6 months of my truck slipping into Tier 2.

However, my journey has taught me that success in trucking doesn’t have to rely solely on luck. By sharing the lessons learned from my experiences in this blog, I aim to empower fellow truckers with the knowledge and insights needed to navigate the challenges we all face within this industry.

If there’s one lesson to take away from my story, it’s the importance of informed decision-making and strategic planning in mitigating the need for luck in your trucking startup. Success is within reach for those who are willing to learn, adapt, and leverage the wisdom shared within our community.

As I continue to share my insights and experiences, I invite you to join me on this journey of discovery and growth. Together, we can build a stronger and more resilient trucking industry for generations to come.